¿Qué es el núcleo DAO?

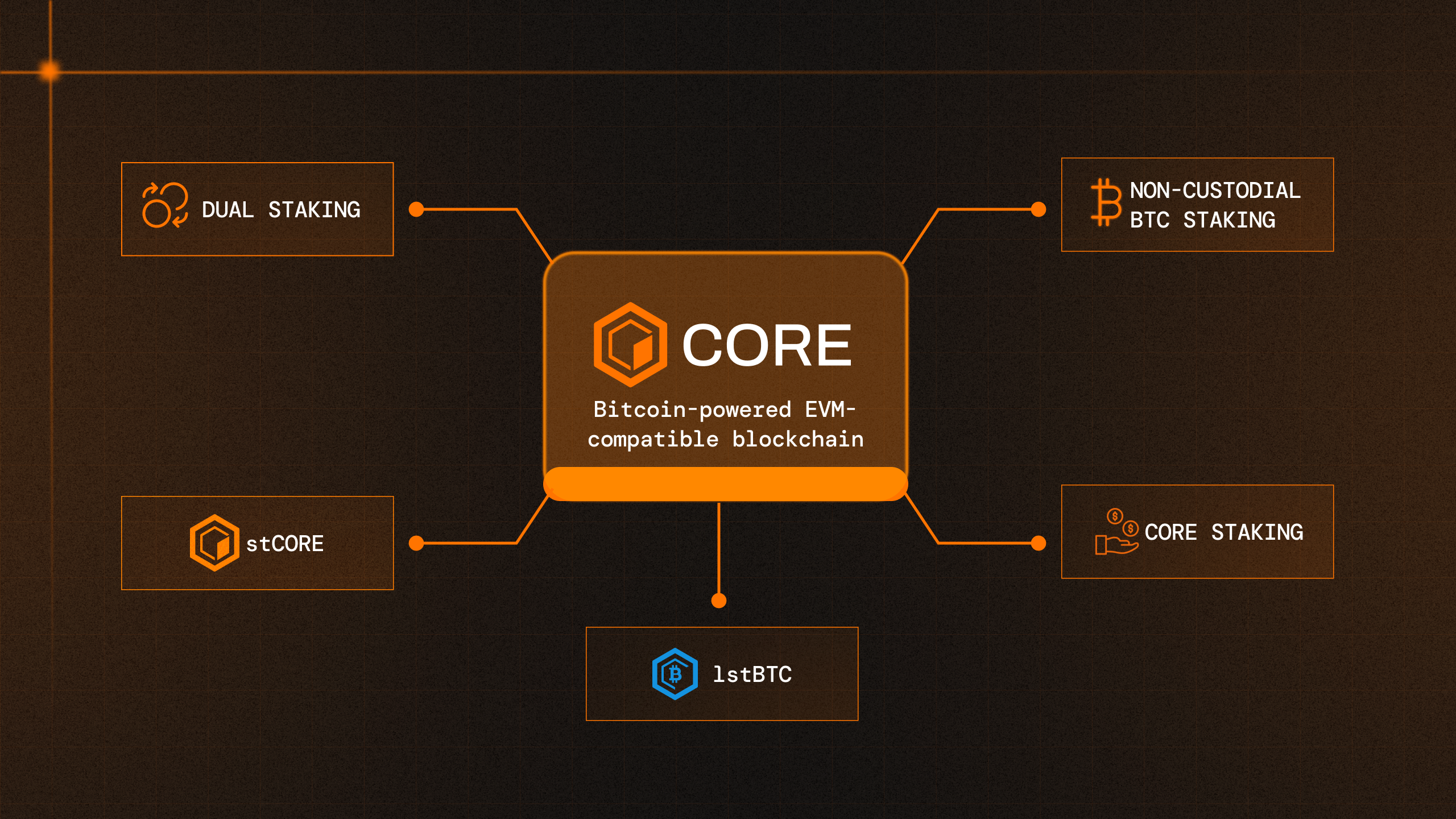

Core is a high-performance, EVM-compatible Layer-1 blockchain, designed to be Bitcoin's complementary and hyper-scalable smart contract platform. By leveraging Bitcoin-native CLTV timelocks, Bitcoin mining hash power, and modern smart contract capabilities, Core unlocks Bitcoin as both the prime protector and central asset of a thriving decentralized application ecosystem.

Core's major innovation is it's novel consensus mechanism, Satoshi Plus, that unites Delegated Proof of Work (DPoW), Delegated Proof of Stake (DPoS), and Self-custodial Bitcoin Staking.

Delegated Proof of Work

The Core blockchain incorporates Bitcoin miners in the security of Turing-complete smart contracts, unlocking the functionality and utility of those miners beyond the simple maintenance of the Bitcoin ledger. Miners can append metadata to newly mined blocks that includes votes for Core validators, providing them with purely additive supplemental income in CORE token rewards. Esta relación simbiótica trabaja para fortalecer Bitcoin sin consumir espacio de bloque de Bitcoin ni restar valor al papel principal de los mineros como defensores de la red Bitcoin.

Self-Custodial Bitcoin Staking

Bitcoin holders leverage Bitcoin's native Check Lock Time Verify (CLTV) functionality to timelock their Bitcoin for a specified period. In exchange for timelocking their coins, Bitcoin holders earn the right to participate in the Core validator election. Within the timelock, holders include metadata to delegate to their chosen validator and specify their reward addresses while maintaining complete custody of their assets. This innovative approach enables Bitcoin holders to participate in Core's consensus mechanism without transferring their Bitcoin, introducing slashing risks, or relying on cross-chain bridges. This mechanism transforms Bitcoin from a static store of value into a productive asset that generates yield while preserving its fundamental security properties.

Delegated Proof of Stake

Alongside Bitcoin stakers, CORE token holders can delegate their CORE tokens to validators to participate in consensus and earn rewards. Staking CORE tokens is also the exclusive way for Bitcoin stakers to earn higher tiers of yield.

Key Features of the Core Blockchain

Some of the distinguishing features of Core:

- Trustless Bitcoin Yield: Core enables Bitcoin holders to earn yield on their Bitcoin without surrendering custody, using Bitcoin's native CLTV function to timelock assets while maintaining complete control. This approach eliminates counterparty risk and smart contract vulnerabilities typically associated with Bitcoin yield strategies, transforming Bitcoin from a static store of value into a productive asset.

- Bitcoin Staking Security Integration: Core's consensus mechanism harnesses Bitcoin as a staking asset, leveraging the most valuable cryptocurrency for its security model. By enabling Bitcoin holders to timelock their assets for validator selection, Core gains security while simultaneously unlocking additional Bitcoin utility.

- Miner Security Integration: Core incorporates Bitcoin miners in securing smart contracts, extending their utility beyond the Bitcoin ledger.

- Dual Staking Higher Bitcoin staking yields are reserved for stakers most aligned with the Core network, as expressed by their staked CORE tokens relative to staked Bitcoin. By tying increased Bitcoin yields to CORE staking, this mechanism creates powerful economic alignment between Bitcoin and CORE holders, contributing to the long-term growth and security of the Core blockchain

- EVM Execution Environment: Core adaptes Ethereum Virtual Machine (EVM) for smart contract execution making it EVM-compatible, similar to BNB Smart Chain's implementation of Geth.

- High-Performance: Core delivers high-throughput transaction processing with optimized consensus, enabling scalable decentralized applications that require speed and responsiveness.

- stCORE: Core's liquid staking token, stCORE, enhances the utility of CORE tokens while simplifying the staking process. By allowing CORE holders to participate in network consensus through validator delegation without locking their assets, stCORE maximizes asset potential with greater flexibility and efficiency while enabling holders to earn rewards and contribute to network security.

- lstBTC (Coming Soon): Issued by Maple Finance and secured by institutional-grade custodians, lstBTC tokenizes Dual Staking, turning yield-bearing timelocked Bitcoin into a liquid token that can be traded and utilized as collateral.

Problems Addressed by the Core blockchain

Core blockchain addresses several key problems and issues in the Bitcoin and broader blockchain space through its unique approach and technology. These include:

-

Bitcoin's Lack of Native Yield: Bitcoin does not have native yield, but it does have native timelocking through the CLTV op_code. Core leverages this existing feature to enable yield generation without bridging or lending risks. When Bitcoin holders timelock their Bitcoin, they can participate in Core validator election to earn yield, creating a secure yield pathway for Bitcoin holders.

-

Bitcoin Capital Inefficiency: Bitcoin typically generates negative carry due to custody costs without producing income, resulting in capital inefficiency for holders. Core addresses this problem by enabling Bitcoin to generate yield through timelock mechanisms and liquid staking options, transforming static holdings into productive assets.

-

Bitcoin Security Limitations: Core extends Bitcoin's security capabilities beyond securing just the Bitcoin ledger, enabling Bitcoin's hashrate and value to secure a complete smart contract ecosystem without requiring modifications to the Bitcoin protocol or detracting from Bitcoin's primary security function.

-

Limited Bitcoin Utility: Core addresses Bitcoin's usability constraints on its native blockchain—where transactions can be slow and expensive—by providing an EVM-compatible environment powered by Bitcoin.

-

Bitcoin Miner Security Budget: Bitcoin miners face a diminishing block reward schedule with halvings every four years, creating sustainability concerns for the security budget. Core provides an additional revenue stream to Bitcoin miners who choose to participate in Satoshi Plus consensus, supplementing their income without requiring any changes to their primary Bitcoin mining operations or compromising Bitcoin's security model.

-

Token Alignment: The CORE token is the exclusive key unlocking higher Bitcoin staking rates, thereby aligning incentives between Bitcoin and CORE stakers. CORE, the native token of the Core blockchain, is used for paying gas fees, participating in governance, and staking. Additionally, CORE has a total supply of 2.1 billion tokens, and a block rewards distribution schedule over 81 years.